Why do we avoid looking at numbers?

Majority of the business owners I know shy away from numbers. There are many reasons for it and here are some of them.

- May be they think they know what is really going on in their business. (So they don’t need to look at numbers to confirm it).

- May be they are afraid it will reveal the truth.

- May be they don’t know how to interpret and make sense of their accounts.

- May be they trust their accountant to guide them.

- May be they are happy with once a quarter/year review with their accountant.

Why numbers become meaningless?

Numbers become meaningless when you look at them long after the event. For an example if you look at your profit and loss account only once a year knowing that the next time you look at the next one, will be in another 12 months time – this makes it meaningless.It is difficult to examine in detail why something happened 10 months ago. And even if you know the reason , it is too late to do something about it.

On track – Off track

In business measuring results has only one purpose. To know whether your business is on ‘on track’ or ‘off track’. When an aircraft takes off, it is off track immediately. It is constantly course correcting to reach its destination. Now imagine an aircraft that does NOT course correct. What are the odds that it would reach its destination on time? Why treat your business differently?

Here is a simple way to use your Profit & Loss to manage your business to powerful effect:

- First set some best practices (see the rest below)

- Have monthly targets for profit & Loss

- Update targets regularly (fortnightly)

- Be as thorough as possible with your forecast

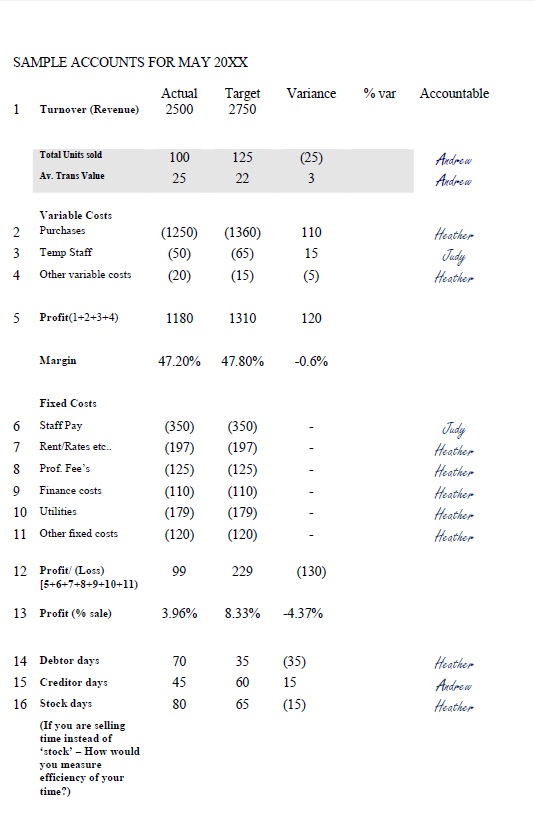

- Have monthly meetings scheduled to review actual v forecast with accountability (See picture below)

- (Bear in mind the P&L need not be 100% accurate in terms of depreciation etc…)

What to do at the monthly meeting:

- Allocate ‘a person accountable’ for each area of P&L

- Review Actual V Target (discover reasons for variance and agree actions if necessary)

- Watch for Trends – Mainly rising/falling Revenues & rising/falling variable costs

- Look for areas of major concern: Falling revenues & Rising costs

Please note that profit and loss is a snap shot of a period. So that profit shown in a p&L will not be the same as money in the bank.

An example below:

Want to share how you do this in your business? Please get in touch via the comments box below.

+ Ravi Peal-Shankar

{ 0 comments… add one now }